Construction Tech, Modular Methods, and Timeline Alpha

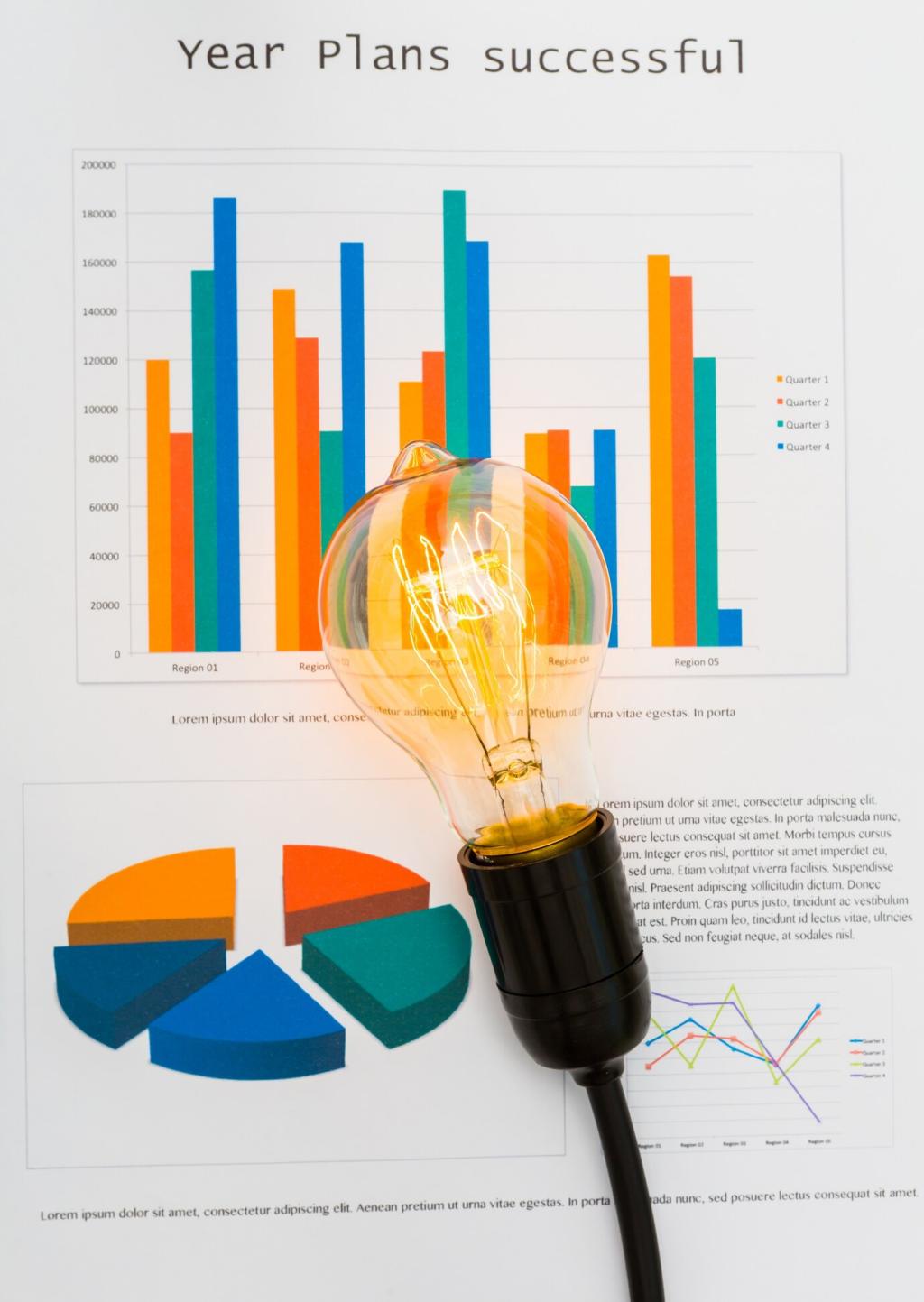

Predictive scheduling flags supply risks, weather windows, and subcontractor bottlenecks before they bite. Shorter build times reduce interest carry and speed lease-up, shifting IRR materially—especially on value-add and ground-up projects in rate-sensitive environments with tight delivery windows.

Construction Tech, Modular Methods, and Timeline Alpha

Material passports and life-cycle tools quantify embodied carbon, unlocking green financing and tenant demand. For select assets, lower-carbon materials now pencil when incentives, marketing lift, and regulatory tailwinds are correctly priced into underwriting and lender conversations from day one.