Evaluating Property Investment Opportunities in Uncertain Markets

Theme selected: Evaluating Property Investment Opportunities in Uncertain Markets. When headlines wobble and forecasts disagree, smart evaluation becomes your compass. Here you’ll find practical frameworks, grounded stories, and actionable checklists to judge deals with clarity amid uncertainty. Share your questions and subscribe to keep these insights coming each week.

Decoding Volatility with Leading Indicators

Blend national data like purchasing managers’ indexes, credit spreads, and consumer sentiment with hyperlocal clues such as new business registrations and building permits. This pairing reveals whether tenant demand is softening or simply shifting. Share which early signals have helped you distinguish short-term noise from structural change.

Interest Rates, Cap Rates, and the Price of Risk

Track the path, not just the point, of interest rates and spreads. Rising financing costs pressure valuations, but cap rates respond unevenly by asset type and submarket. Evaluate sensitivity: a 50-basis-point swing can remake returns. Tell us how you model cap rate drift across scenarios in your underwriting.

Employment, Migration, and Resilient Demand

Tenant demand survives turbulence where jobs, training pipelines, and migration flows remain strong. Compare sector resilience—healthcare, logistics, and public institutions—against cyclical employers. Walk neighborhoods at commute times to witness real activity. What local demand metric has surprised you most during a downcycle? Join the discussion below.

Risk-First Underwriting: Build Deals That Can Survive the Storm

Stress-Testing Cash Flows with Realistic Shocks

Model break-even occupancy, delayed lease-up, and expense spikes for insurance, taxes, and utilities. Layer tenant defaults and re-leasing downtimes that reflect today’s absorption, not last cycle’s optimism. A disciplined downside creates conviction to act. Share your favorite stress-test levers and how they’ve changed this year.

Walking the Block and Interviewing the Street

Visit at awkward hours: early mornings, late evenings, and rainy days. Count ‘for lease’ signs, talk to delivery drivers, and note which storefronts reopen after holidays. These small observations help you evaluate tenant durability better than glossy reports. What detail has changed your opinion on a deal?

Permits, Zoning, and Policy Drift

Evaluate entitlement timelines, permit backlogs, and proposed ordinances. A subtle zoning tweak can reshape competitive supply and your exit. Check tax reassessment schedules and utility capacity constraints. Policy is slow until it is suddenly fast. Have you ever saved a deal by uncovering a regulatory nuance? Tell us.

Tenant Quality, Lease Clauses, and Default Pathways

Scrutinize tenant credit, co-tenancy provisions, and termination rights. Analyze sales-to-rent ratios, corporate guarantees, and parent company exposure. In uncertainty, lease language determines cash flow stability. What tenant diligence techniques give you the most confidence when the economy is wobbling? Share your checklist.

Price vs. Value: Comping Smarter When Comps Are Noisy

Normalize T-12s and Reconstruct the P&L

Adjust trailing financials for one-time concessions, deferred maintenance, and insurance resets. Separate controllable from non-controllable expenses and rebuild management assumptions. This disciplined normalization anchors evaluation to reality, not seller narratives. What’s your go-to adjustment that frequently flips a deal’s appeal?

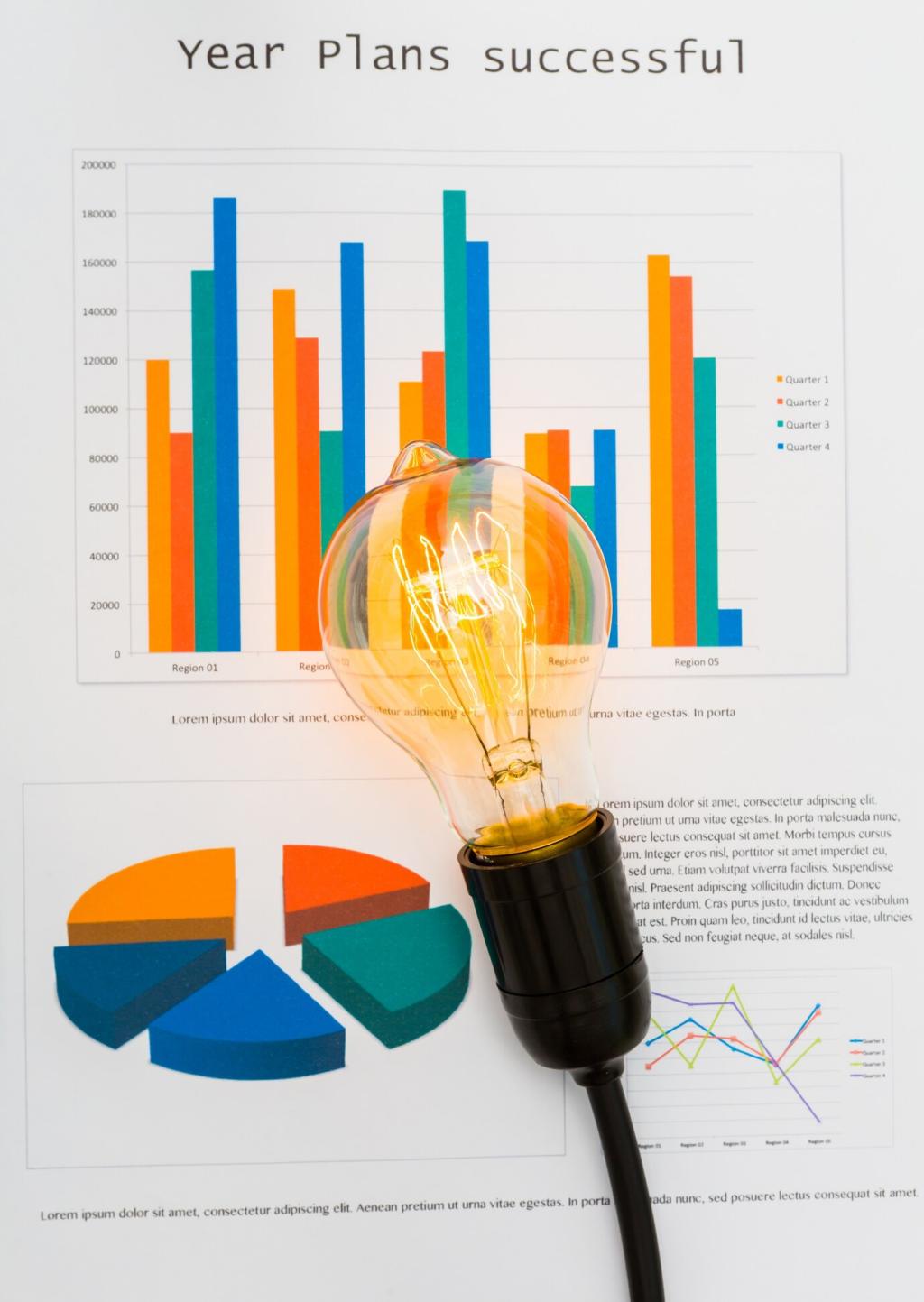

Forward-Looking NOI and Scenario Trees

Model multiple rent and vacancy paths tied to realistic leasing velocity and market absorption. Cap the midpoint, not the rosiest branch. Then compare scenario-weighted values to asking price. This approach clarifies where uncertainty truly lives. Do you use trees, Monte Carlo, or simple sensitivity tables? Tell us why.

Negotiation Levers in Choppy Conditions

When pricing gaps persist, negotiate credits for capital items, rent guarantees, or phased closings tied to milestones. Structure earn-outs aligned with actual performance. Evaluation is incomplete without creative paths to bridge risk. What term have you secured recently that protected downside without scaring the seller?

Micro-Renovations with Outsized Cash Flow

Target turns that compress downtime: pre-ordered materials, modular finishes, and energy-efficient fixtures eligible for rebates. Small upgrades can justify rent bumps and reduce maintenance calls. Evaluation should price these improvements conservatively yet credibly. Which renovation produced the best ROI for you during a slow leasing season?

Dynamic Leasing and Flex Space Options

Offer flexible terms, step rents, and pop-up clauses to capture hesitant tenants. Evaluate yield per square foot across different layouts rather than fixating on headline rent. Optionality becomes an asset class in uncertainty. How have you used flexibility to backfill space without diluting long-term positioning?

Case Study: Buying a Mixed-Use Building When Everyone Else Paused

In late autumn, a corner mixed-use asset lingered on market after two fall-throughs. The street felt quiet, but coffee cups still lined the local café’s window at 7 a.m. That small signal sparked deeper evaluation instead of walking away. What tiny clue has nudged you to look twice?

Building an Anti-Fragile Portfolio: Evaluation Beyond a Single Deal

Barbell Strategies and Cycle-Aware Exposure

Blend steady, income-heavy assets with selective value-add projects. Evaluate correlations, not just returns, so one shock doesn’t ripple everywhere. Maintain dry powder for dislocations. How do you balance dependable cash flow with opportunistic upside when the future refuses to sit still?

Exit Optionality and Time Arbitrage

Design multiple exit paths—refi, partial sale, or condo map—before you bid. Evaluation should price the option to wait, especially when liquidity thins. Optionality often beats precision in forecasts. What creative exits have you modeled that changed your willingness to proceed?

Governance, Dashboards, and Habit Loops

Set decision calendars, red-flag triggers, and simple dashboards tracking coverage, leasing velocity, and reserve health. Evaluation improves when feedback loops are fast and unemotional. Share the single dashboard metric you refuse to ignore, and subscribe for a template you can adapt today.