Inflation, Rates, and Cap Rates: The Pricing Triangle

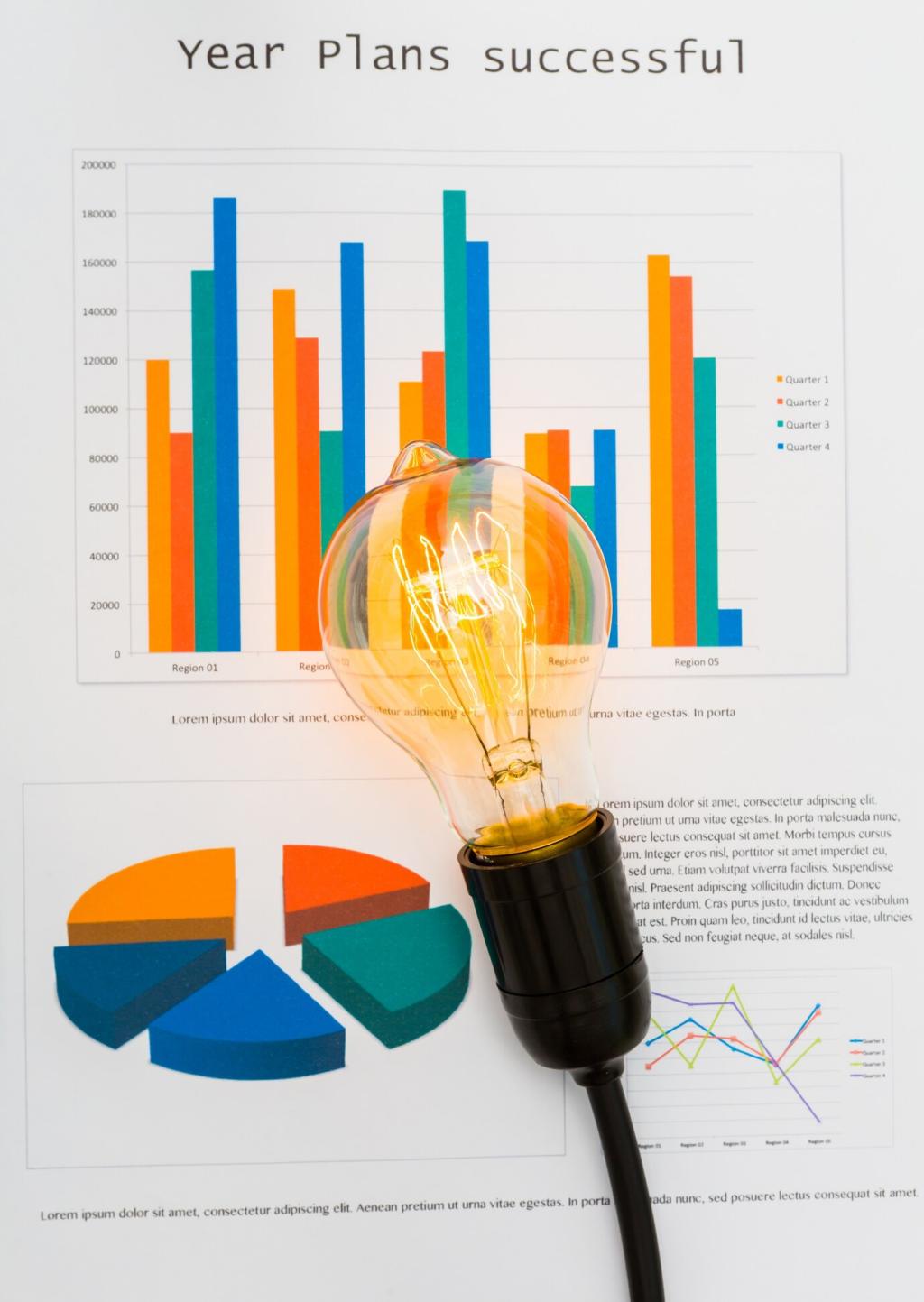

Headline vs. core inflation tells different stories for operating expenses and rent escalation clauses. Elevated shelter inflation can lag real-time rents; use alternative rent trackers and leasing comps to validate whether CPI is exaggerating or understating your market’s momentum.

Inflation, Rates, and Cap Rates: The Pricing Triangle

An inverted yield curve often foreshadows slower growth and tighter lending. Track the 10-year Treasury, mortgage spreads, and lender sentiment to anticipate refinance windows, debt service coverage challenges, and opportunities to lock favorable fixed-rate terms before volatility returns.

Inflation, Rates, and Cap Rates: The Pricing Triangle

Compare target asset cap rates to the 10-year Treasury to gauge compensation for risk. Widening spreads may signal buyer caution or distressed opportunities; narrowing spreads often imply competitive bidding and the need for stronger value-creation plans.

Inflation, Rates, and Cap Rates: The Pricing Triangle

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.